US Tech 100 Index approaching support of a Cunha descendente

US Tech 100 Index is approaching the support line of a Cunha descendente. It has touched this line numerous times in the last 2 days. If it tests this line again, it should do so in the next 7 hours.

Will US Small Cap 2000 Index have enough momentum to break support?

US Small Cap 2000 Index is heading towards the support line of a Triângulo Descendente and could reach this point within the next 3 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the […]

Either a rebound or a breakout imminent on Unitedhealth Group Inc.

Unitedhealth Group Inc. is heading towards a line of 528.0200. If this movement continues, the price of Unitedhealth Group Inc. could test 528.0200 within the next 20 hours. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be short-lived and end up rebounding.

Either a rebound or a breakout imminent on US Wall Street 30 Index

US Wall Street 30 Index is heading towards the support line of a Cunha descendente. If this movement continues, the price of US Wall Street 30 Index could test 30383.2111 within the next 3 days. It has tested this line numerous times in the past, so this movement could be short-lived and end up rebounding […]

What’s going on with US SPX 500 Index?

Those of you that are trend followers are probably eagerly watching US SPX 500 Index to see if its latest 1,25% move continues. If not, the mean-reversion people out there will be delighted with this exceptionally large 19 hours move.

Breach of important price line imminent by US Small Cap 2000 Index

US Small Cap 2000 Index is moving towards a line of 1821.4900 which it has tested numerous times in the past. We have seen it retrace from this position in the past, so at this stage it isn’t clear whether it will breach this price or rebound as it did before. If US Small Cap […]

Breach of important price line imminent by Microsoft Corporation

Microsoft Corporation is moving towards a line of 249.9400 which it has tested numerous times in the past. We have seen it retrace from this position in the past, so at this stage it isn’t clear whether it will breach this price or rebound as it did before. If Microsoft Corporation continues in its current […]

US Tech 100 Index approaching resistance of a Cunha ascendente

US Tech 100 Index is approaching the resistance line of a Cunha ascendente. It has touched this line numerous times in the last 5 days. If it tests this line again, it should do so in the next 15 hours.

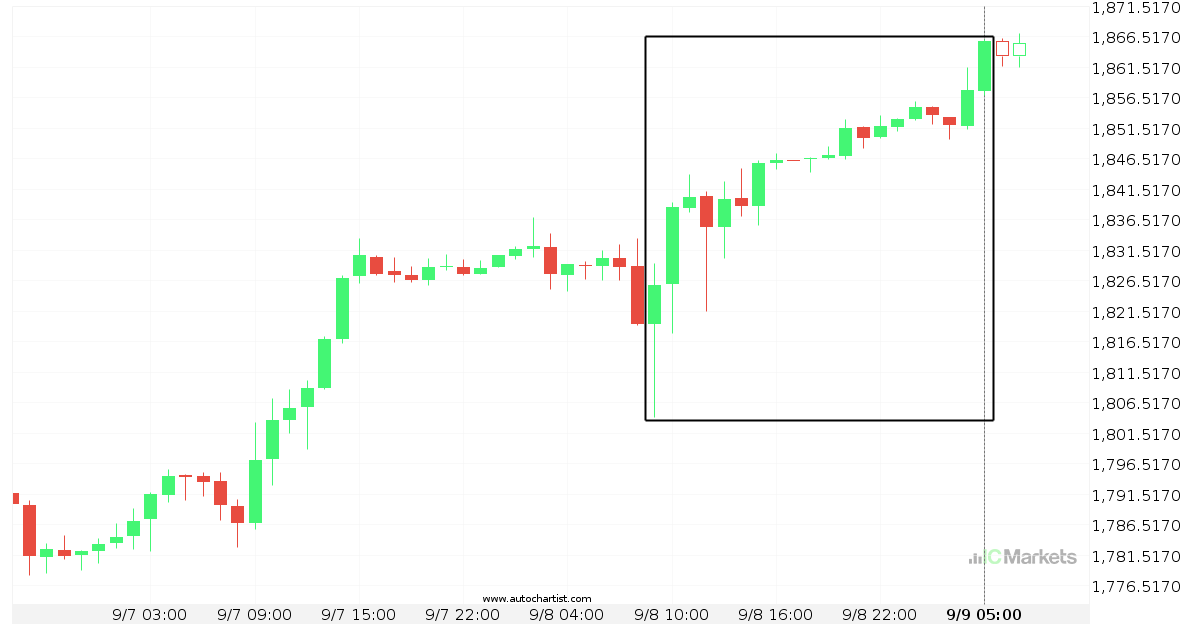

US Small Cap 2000 Index experienced an exceptionally large movement

For those of you that don’t believe in trends, this may be an opportunity to take advantage of an exceptional 2,19% move on US Small Cap 2000 Index. The movement has happened over the last 20 hours. For those trend followers among you, you may think about riding this possible trend.

A final push possible on US Small Cap 2000 Index

US Small Cap 2000 Index is heading towards 1833.4301 and could reach this point within the next 12 hours. It has tested this line numerous times in the past, and this time could be no different, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we could see a retracement back […]